BLOG_PAGE.section-article.category.rwa-

The Rise of Tokenized Real-World Securities (RWA 2.0)

投稿をシェア

概要

Learn how tokenized stocks and bonds use blockchain for fast trades and direct custody, and see how wallets like Trust Wallet enable access.

Key Takeaways

Tokenized securities replicate stocks and bonds on blockchains, enabling near-instant settlement and direct peer-to-peer transfers.

Institutions like BlackRock, Franklin Templeton and Goldman Sachs have issued successful tokenized funds and bonds, demonstrating real-world viability.

Crypto wallets, led by Trust Wallet, now support tokenized securities with features for dividends, compliance and integration with decentralized finance.

Traditional financial securities are making a major shift onto blockchain networks. Stocks, bonds, and other regulated investments that once required complex paperwork and multiple intermediaries are now being converted into digital tokens that can be stored in crypto wallets. The movement onto blockchain is bringing the benefits of blockchain technology to traditional finance while maintaining the regulatory protections investors expect. In this article, we will explore how securities tokenization works, examine real examples that are already operational, and show how wallets are becoming the gateway for accessing these new digital investments.

How Tokenized Securities Work

Tokenized securities are digital tokens that represent ownership of stocks or bonds on a blockchain. Issuers create smart contracts that mirror the rights and restrictions of traditional securities. Trading restrictions or lock-up periods are embedded in code, and ownership records live on-chain rather than in centralized databases. The setup preserves legal protections and regulatory compliance while adding benefits like near-instant settlement and direct, peer-to-peer transfers.

Real-World Examples

Major financial firms and governments have launched tokenized securities. BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) holds nearly $3 billion in U.S. Treasury bills on Ethereum, offering same-day settlement. Franklin Templeton’s OnChain U.S. Government Money Fund (FOBXX) manages over $760 million, enabling investors to trade shares directly without brokers. Goldman Sachs issued a €100 million bond for the European Investment Bank that settled in under 60 seconds instead of the usual five days. Governments like Slovenia and the Philippines have also issued tokenized bonds, proving the model works across public and private sectors.

Settlement and Trading Improvements

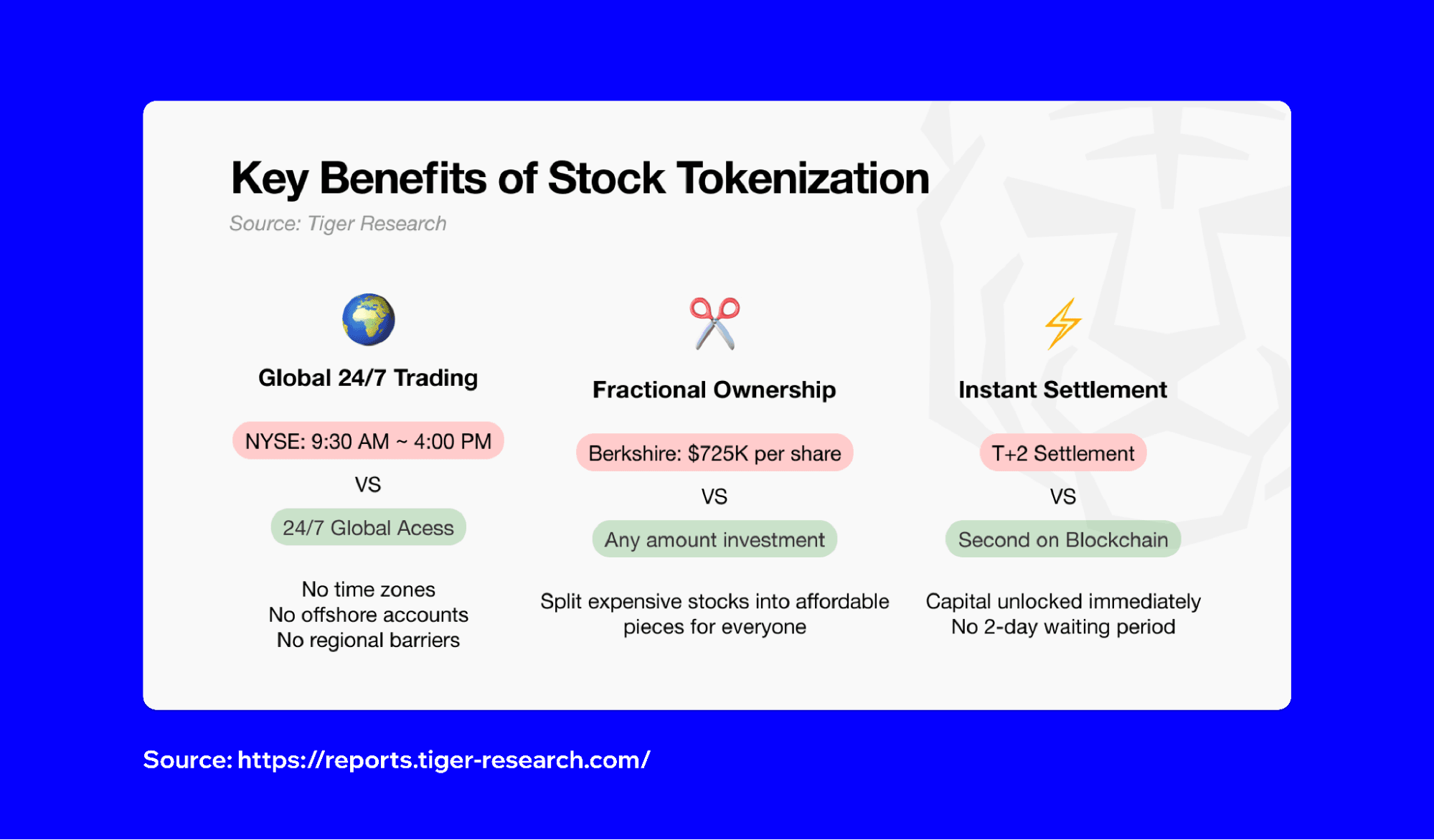

Conventional trades require clearinghouses, custodians and multiple databases, often taking one to two days. Tokenized securities streamline trading by using the blockchain as the clearing and record-keeping system, reducing intermediaries and settlement time to minutes. Smart contracts automate dividend and interest payments, cutting costs and manual errors common in traditional processes.

Regulatory Compliance

Tokenized securities must meet the same rules as paper securities. In the U.S., the SEC treats them identically, enforcing registration, disclosures and investor protections. Europe’s MiCA regulation classifies tokenized securities as financial instruments under existing laws. Jurisdictions like Singapore, Switzerland and the U.K. have published guidelines that ensure tokenized assets follow familiar regulations, giving institutions confidence to participate.

Wallet Integration

Crypto wallets are becoming the gateway for tokenized securities. Instead of holding stocks in brokerage accounts, investors can store digital shares in wallets where they control private keys. Trust Wallet leads the trend, supporting tokenized stocks like Apple, Tesla and Amazon. Enhanced wallet features enable secure storage, trading and integration with decentralized finance services using tokenized assets as collateral.

Benefits for Investors

Tokenized securities offer faster settlement, often minutes instead of days, reducing counterparty risk and improving capital efficiency. They enable 24/7 trading, giving investors flexibility beyond traditional market hours. Fractional ownership enables dividing tokens into smaller units, making high-price assets more accessible. Tokenization cuts fees and administrative costs, with smart contracts automating corporate actions for both issuers and investors.

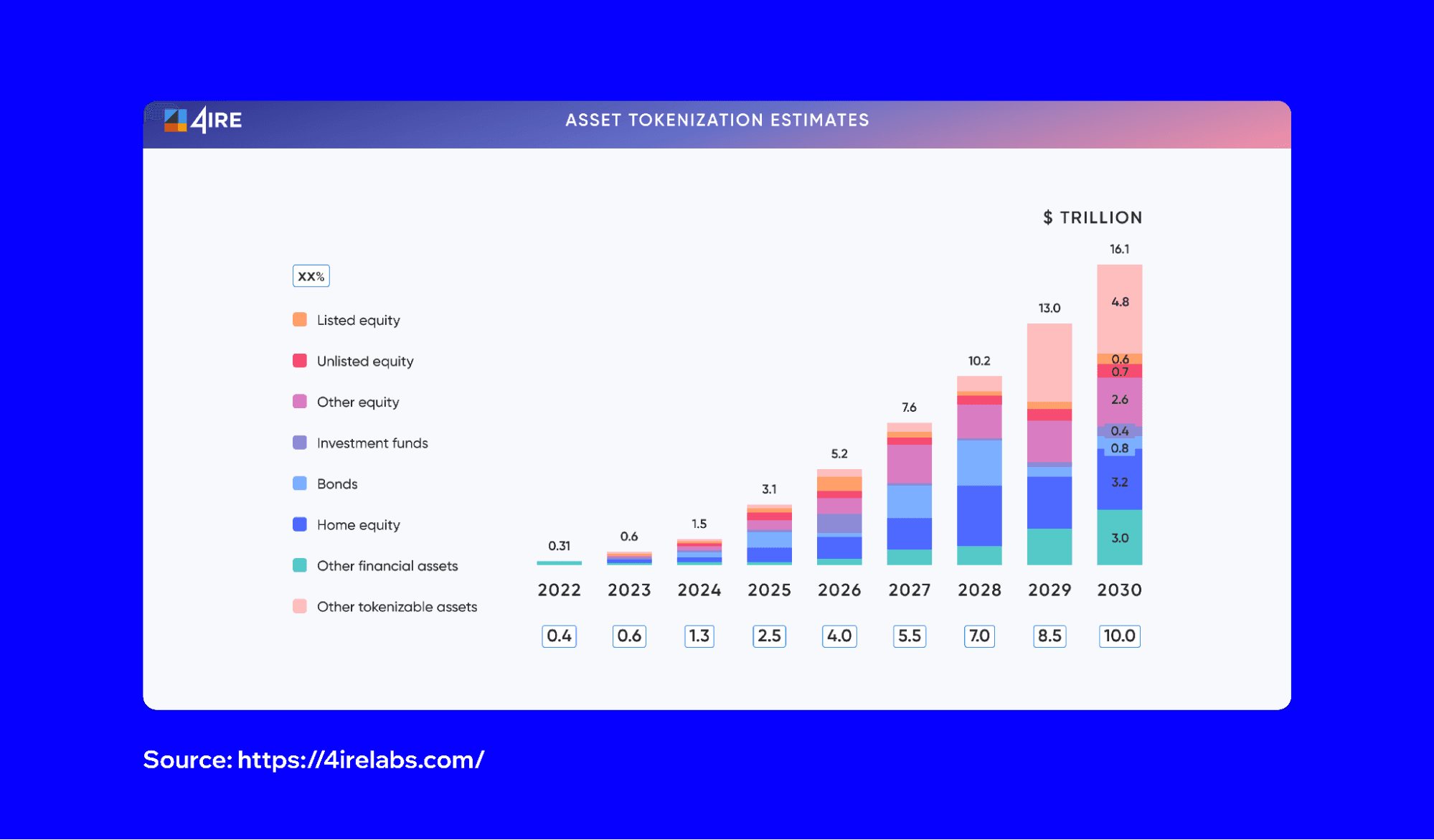

Market Size and Growth

As of 2025, tokenized securities total about $24 billion, up from $10 billion in 2024. Projections estimate $2–4 trillion by 2030. Money market funds and U.S. Treasury products are the largest segment, with over $5.75 billion in tokenized assets. Growth is driven by institutional launches and clearer regulations, creating a robust ecosystem for tokenized financial products.

How to Access RWAs in Trust Wallet

Open the Trust Wallet app and go to the Swaps tab

Search for a ticker (like TSLAon or AAPLon) or scroll to find RWA tokens listed with other assets

Select the asset, enter the amount you want to swap, and proceed

Confirm the swap and receive your token

Looking Ahead

Tokenized securities enhance traditional finance rather than replace it. Tokenized securities offer a practical path forward, preserving regulatory standards and adding blockchain efficiencies. As more assets go on-chain, wallets like Trust Wallet are important for trading and managing these digital investments. The shift is already here, reshaping how investors own and trade securities in the digital era.

Download Trust Wallet Disclaimer: Content is for informational purposes and not investment advice. Web3 and crypto come with risk. Please do your own research with respect to interacting with any Web3 applications or crypto assets. View our terms of service. Join the Trust Wallet community on Telegram. Follow us on X (formerly Twitter), Instagram, Facebook, Reddit, Warpcast, and Tiktok

Note: Any cited numbers, figures, or illustrations are reported at the time of writing, and are subject to change.