Leitfaden

Avoiding Slippage and Hidden Fees When Swapping Tokens

Beitrag teilen

Wichtigste Punkte

Learn how to avoid slippage and hidden fees when swapping tokens, manage gas costs on Ethereum, and optimize your crypto trades effectively.

Swapping tokens is an important part of using decentralized finance, but it can come with unexpected costs that eat into your gains. Many people encounter slippage and hidden fees without fully understanding how these issues arise or how to avoid them. This article will explain what slippage and hidden fees are, how they affect your trades, and practical ways you can minimize their effect.

Key Takeaways

Slippage occurs when the price of a token changes between the time you start a swap and when it is finalized, which can result in receiving fewer tokens than expected.

Adjusting the slippage tolerance setting on your swap helps control how much price movement you are willing to accept before a transaction is canceled.

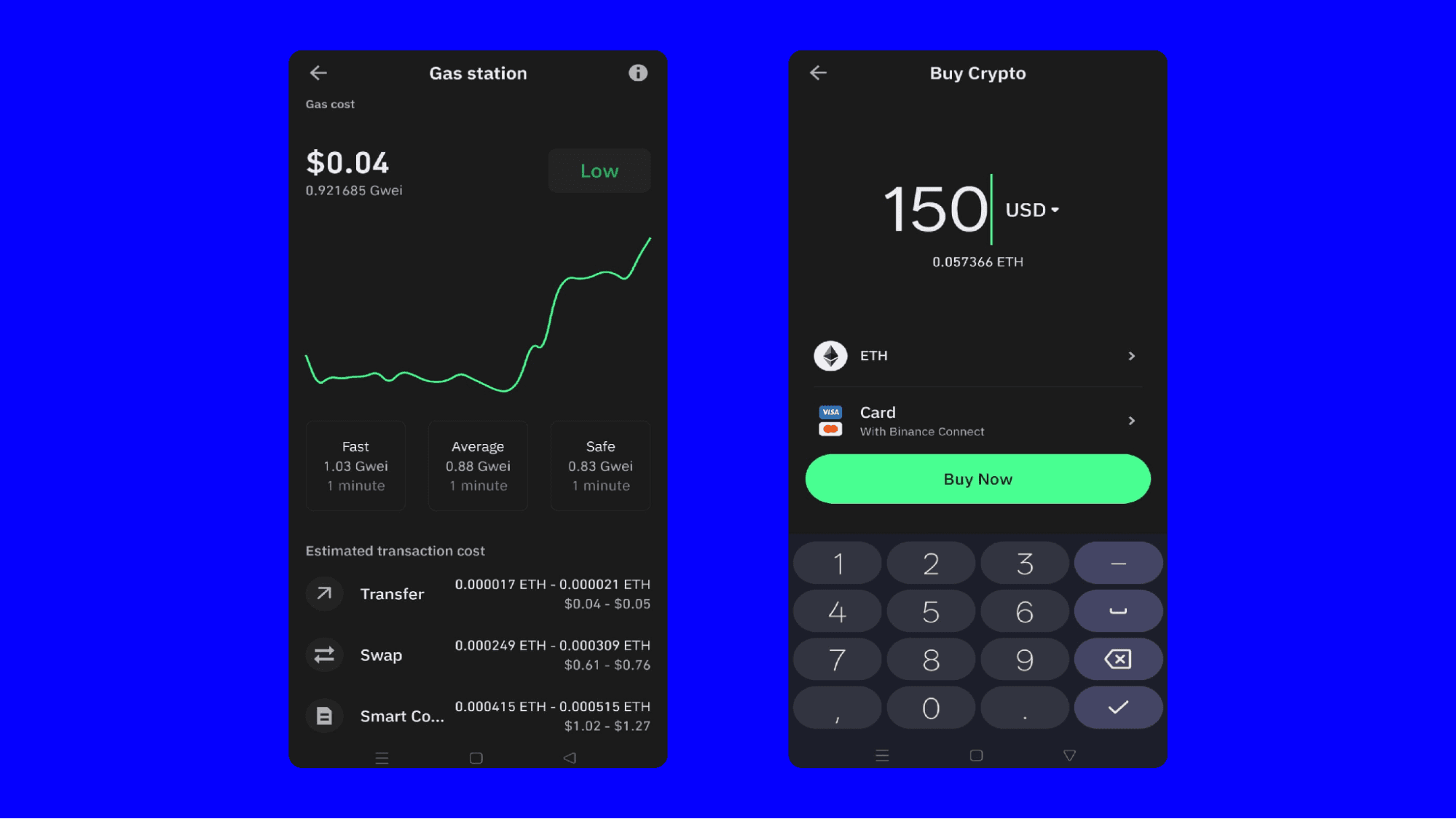

Gas fees on Ethereum can vary widely depending on network congestion. Swapping during off-peak times or using Layer 2 solutions can help reduce costs.

Understanding Slippage in Token Swaps

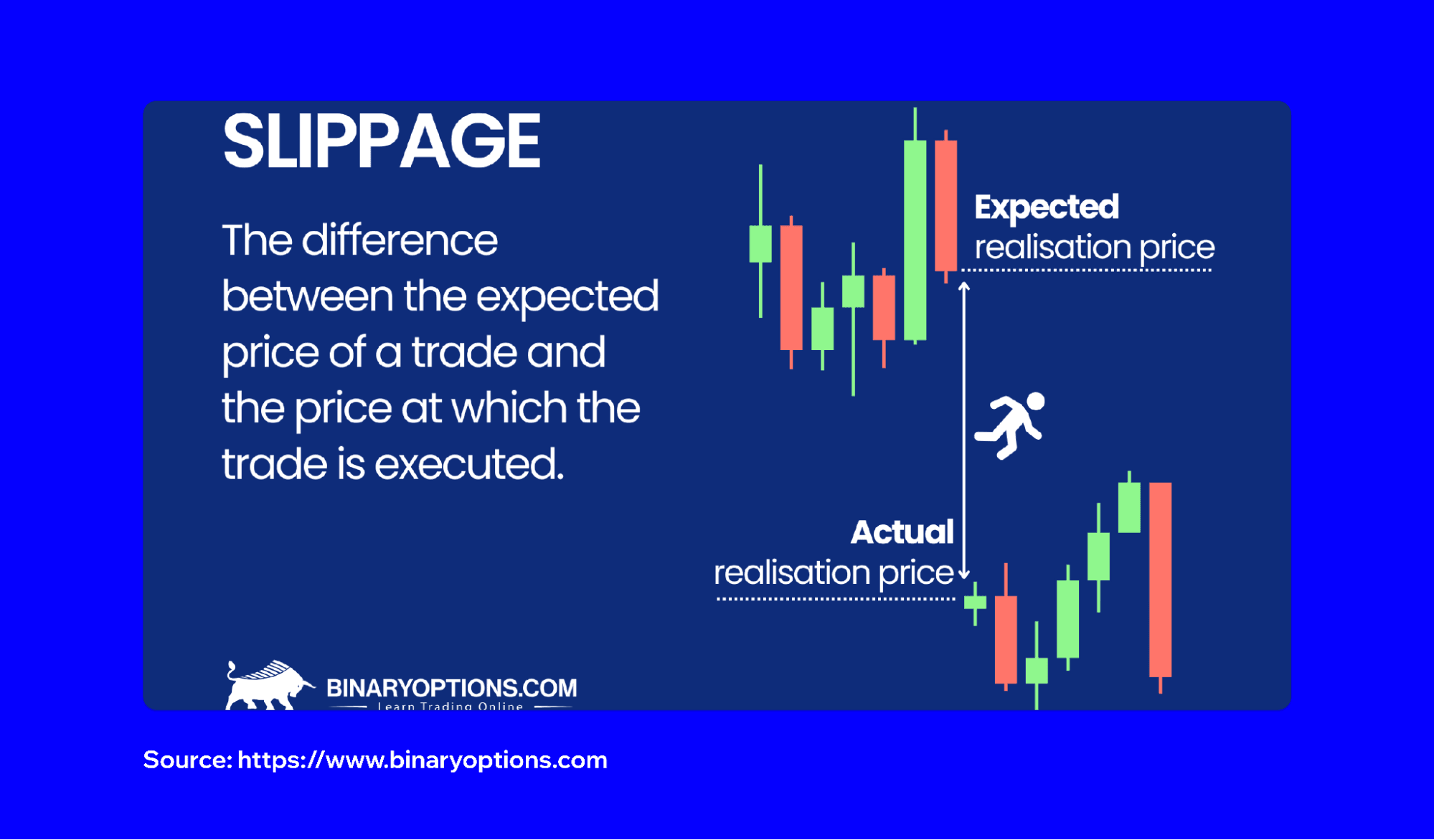

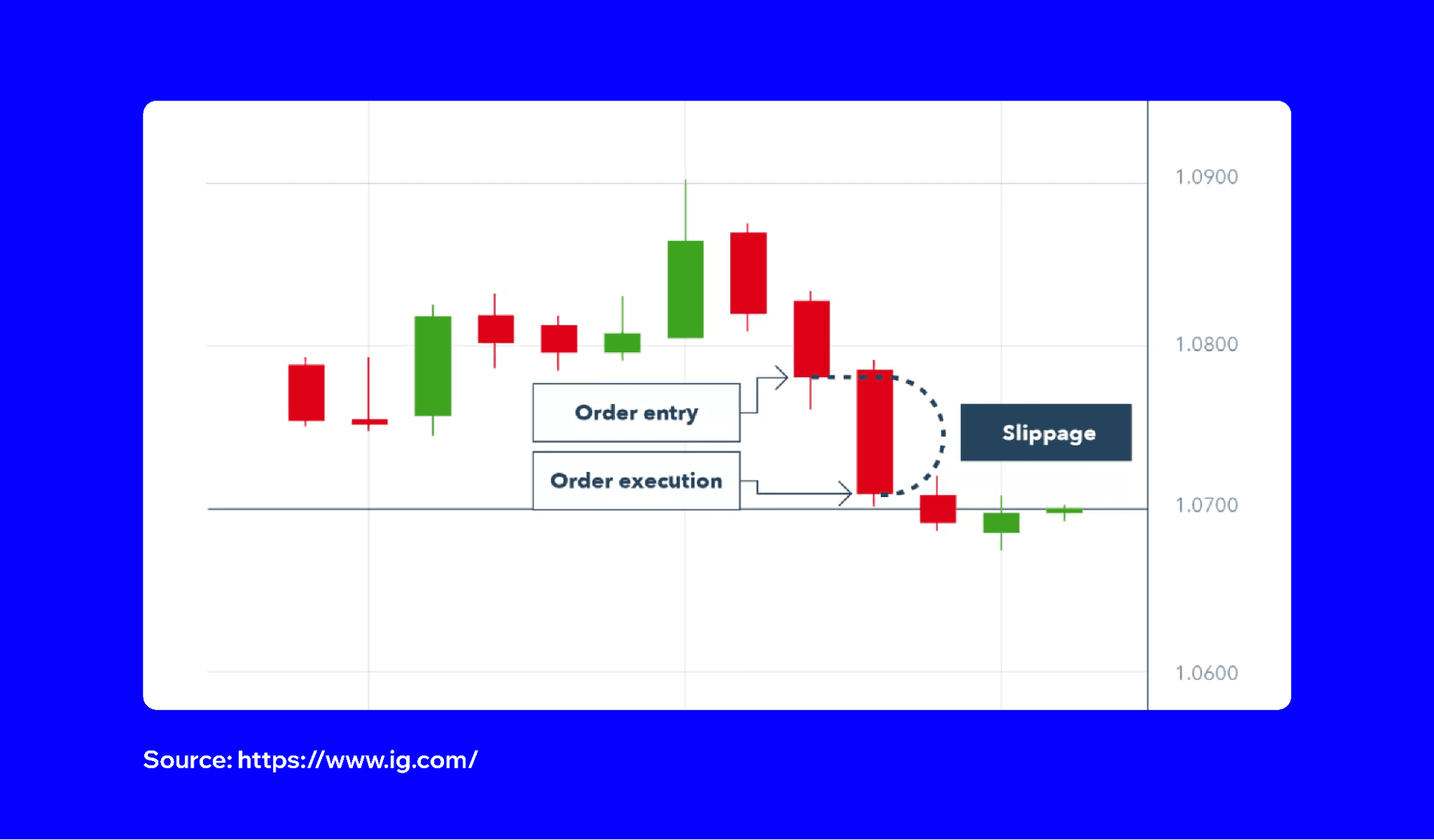

Slippage is the difference between the price you expect to pay for a token and the price you pay when the transaction is executed. In decentralized exchanges, prices are determined by liquidity pools rather than traditional order books. When you initiate a swap, the price can change in the seconds it takes for your transaction to be confirmed on the blockchain. This is especially true during periods of high volatility or when trading less liquid tokens. If you try to swap a large amount of a token in a pool with limited liquidity, your trade can move the market price against you, causing you to receive fewer tokens than you anticipated.

The percentage of slippage is calculated by comparing the expected price to the executed price. If you expected to pay $100 for a token but ended up paying $102, your slippage is 2%. Slippage can sometimes work in your favor, but it more often results in a less favorable outcome, particularly in fast-moving or illiquid markets.

The Importance of Liquidity

Liquidity is a key factor in slippage. Pools with high liquidity can absorb larger trades without a large effect on price, while pools with low liquidity are more sensitive to large trades. Before swapping, it’s wise to check the liquidity of the pool you are using. If the pool is shallow, even a moderately sized trade can cause substantial slippage. Many decentralized exchanges display liquidity information, enabling you to make informed decisions about where and when to trade.

Setting Slippage Tolerance

To protect yourself from excessive slippage, most decentralized exchanges enable you to set a slippage tolerance. Slippage tolerance is the maximum percentage of price movement you are willing to accept for your trade. If the price shifts beyond your set tolerance before the transaction is confirmed, the swap will automatically fail, helping you avoid unexpectedly poor rates. Setting your tolerance too low can cause transactions to fail frequently, especially in volatile markets, which means you could end up paying gas fees for failed trades. Setting it too high leaves you vulnerable to front-running bots and large price changes. Finding the right balance is important: for stablecoins or highly liquid pairs, a low tolerance works well, while more volatile or illiquid tokens require a slightly higher setting.

Gas Fees on Ethereum

Gas fees are a consideration when swapping tokens, particularly on Ethereum. Every transaction on the Ethereum network requires gas, which is paid in ETH. The cost of gas fluctuates based on network demand and the complexity of your transaction. During periods of high demand, gas fees can spike dramatically, making even simple swaps expensive. Gas fees are not always obvious at first glance, but they can increase the total cost of your trade.

The Ethereum network calculates gas fees using a combination of a base fee, which adjusts according to network congestion, and a priority fee, which acts as a tip to incentivize miners or validators to process your transaction more quickly. As a result, fees can be unpredictable, and timing your transaction can make a difference in how much you pay.

Managing and Reducing Gas Costs

To minimize gas fees, swap during periods of low network activity, like late at night or on weekends. Monitoring Ethereum gas trackers can help you identify the best times to transact. Another effective strategy is to use Layer 2 networks, like Arbitrum or Base, which process transactions off the Ethereum mainnet and reduce fees. Layer 2 solutions enable you to enjoy the benefits of Ethereum’s security while avoiding the high costs associated with mainnet transactions. Some people also take advantage of gas tokens, which are minted when fees are low and redeemed when fees are high, helping to offset costs.

Hidden Fees: Where They Lurk

Hidden fees can take several forms in the world of token swaps. Some decentralized exchanges charge additional fees on top of network costs, like platform fees or minimum swap charges. The fees can be especially noticeable for smaller trades, where a flat fee might represent a large percentage of your transaction. Different blockchains have varying fee structures. Swapping ERC-20 tokens on Ethereum is generally more expensive than swapping tokens on BNB Chain or Solana. It’s important to review all potential charges before you confirm a trade. Aggregator platforms can help by comparing rates across multiple exchanges and highlighting the true cost of each option, enabling you to choose the most cost-effective route.

How to Buy Ethereum Using Trust Wallet

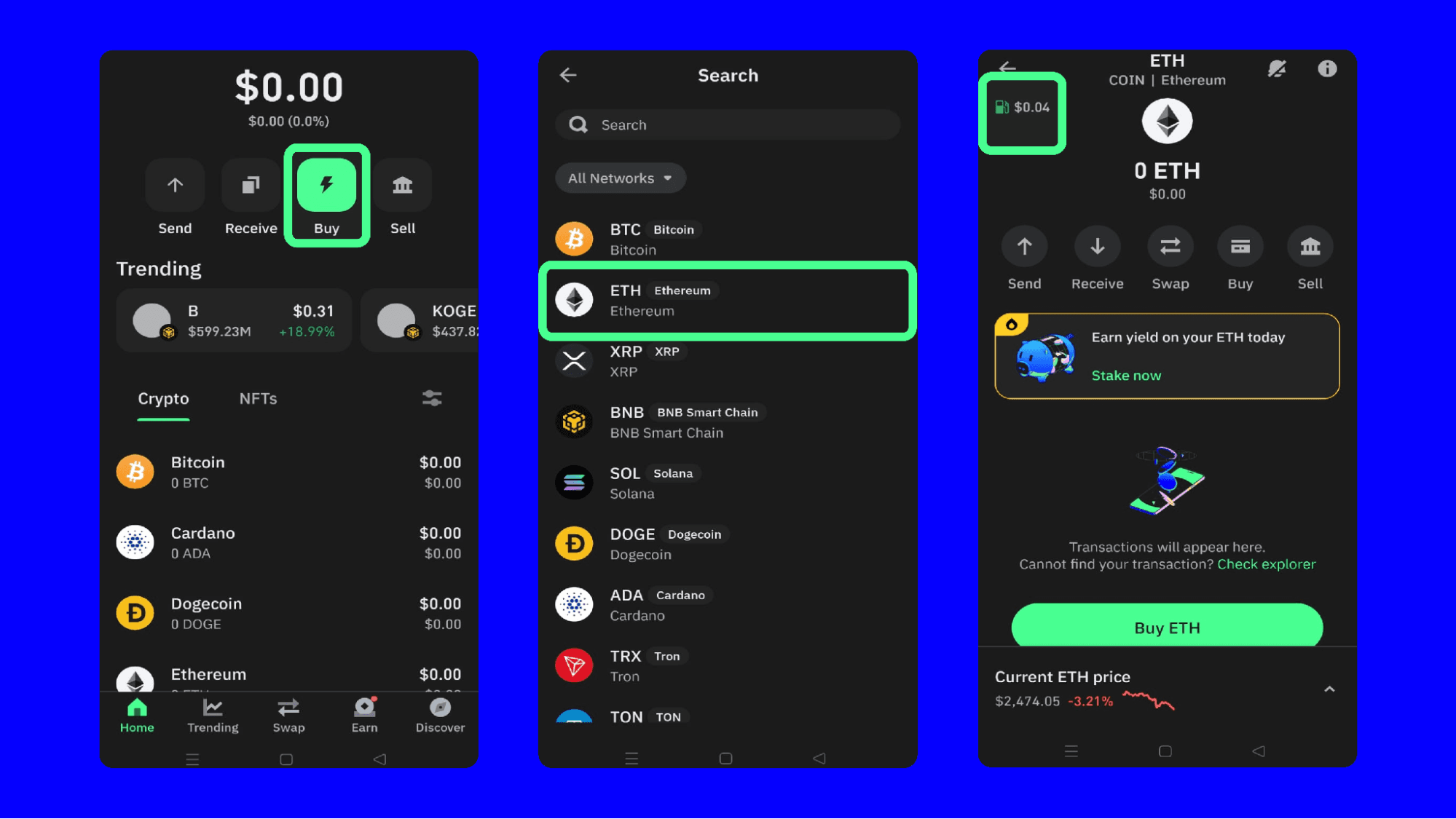

You can buy crypto, including Bitcoin, using Trust Wallet, via our trusted partners. Here’s how:

Search for “Ethereum” or “ETH” and select it.

To check gas fees, tap the icon at the top of the screen

Select “Buy”

Choose your preferred currency, then enter the amount of ETH you want to purchase.

Select the third-party provider & payment method you’d like to use.

Select the Buy button and complete the remaining steps.

Making Smart Swaps

The key to avoiding slippage and hidden fees is preparation and awareness. Start by checking the liquidity of your chosen pool and setting an appropriate slippage tolerance for your trade. Be mindful of Ethereum gas fees, and use Layer 2 solutions or time your swaps for periods of lower network activity. Always review the details of your transaction before confirming, including any platform or network fees that may apply. You can ensure that you get the most value from your token swaps and avoid unpleasant surprises by taking these steps.

Disclaimer: Content is for informational purposes and not investment advice. Web3 and crypto come with risk. Please do your own research with respect to interacting with any Web3 applications or crypto assets. View our terms of service.

Join the Trust Wallet community on Telegram. Follow us on X (formerly Twitter), Instagram, Facebook, Reddit, Warpcast, and Tiktok

Note: Any cited numbers, figures, or illustrations are reported at the time of writing, and are subject to change.