Guides

The Smart Way to Hold: How to Grow Your Crypto Passively in Trust Wallet

Share post

In Brief

Learn how to optimize your crypto holding strategy with Trust Wallet through staking, Stablecoin Earn, and DeFi protocols for consistent returns.

Key Takeaways:

Trust Wallet offers options to grow your crypto holdings, including staking, Stablecoin Earn, and access to DeFi protocols through the dApp browser.

Rewards are calculated and distributed automatically through smart contracts, with staking yields varying based on network conditions and validator performance.

The dApp browser opens access to advanced strategies like lending protocols and yield optimizers for additional earning opportunities.

Holding crypto in a wallet doesn't mean your assets have to sit idle. Trust Wallet gives you ways to put your digital assets to work and grow your crypto holdings while maintaining control of your digital assets. This article walks you through the earning options available directly within Trust Wallet, from straightforward staking to advanced DeFi strategies that can help grow your portfolio over time.

Getting Started with In-Wallet Options

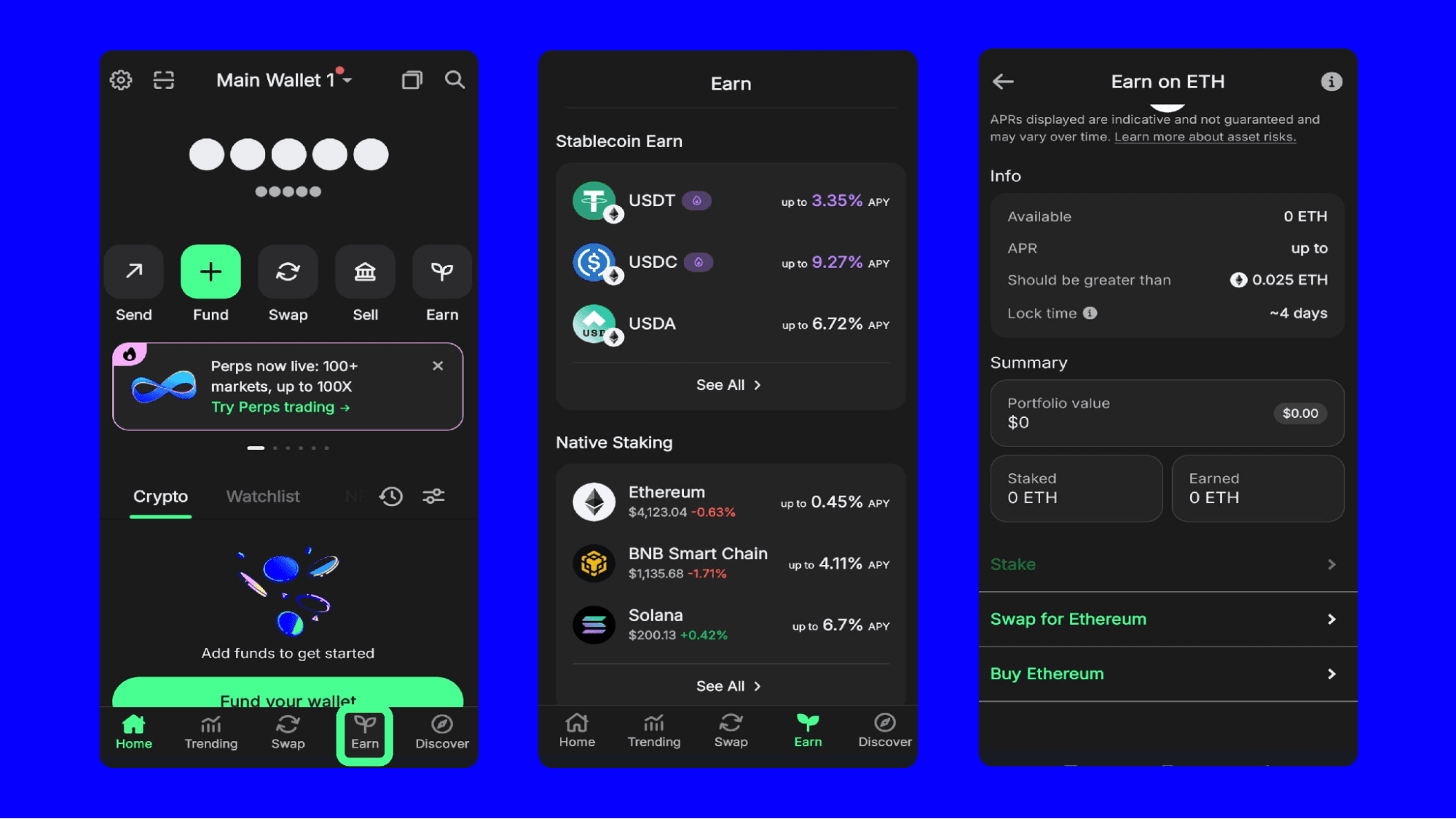

Trust Wallet has built earning features directly into the app, making it simple to start generating returns without needing to navigate external platforms. The Earn section on your home screen is your gateway to these opportunities.

The platform supports over 24 different cryptocurrencies for staking, each with its own annual percentage rate. APR varies based on network conditions and the specific blockchain you choose to support. When you stake through Trust Wallet, you're helping secure blockchain networks while earning rewards for your contribution.

Understanding Staking in Trust Wallet

When you stake, you lock up your cryptocurrency to help maintain and secure a blockchain network. In return, you earn rewards. Trust Wallet partners with infrastructure providers, like Kiln, to offer pooled staking, which means your assets are combined with those of other people to meet minimum staking requirements. Pooled staking is accessible even if you don't have large amounts to commit.

Once you deposit your tokens into the staking pool, they begin earning rewards that accrue daily. The process is handled automatically in the background through smart contracts, which track your stake and distribute rewards proportionally based on your holdings.

When you stake, your tokens are not available for trading or transferring until you choose to unstake them. There is a minimum duration for staking called the lockup period. During the lockup period, you cannot withdraw or transfer your staked tokens. When you decide to unstake, you initiate the process through the app. Your original staked tokens and your rewards will become available after the lockup period ends.

Earning with Stablecoins

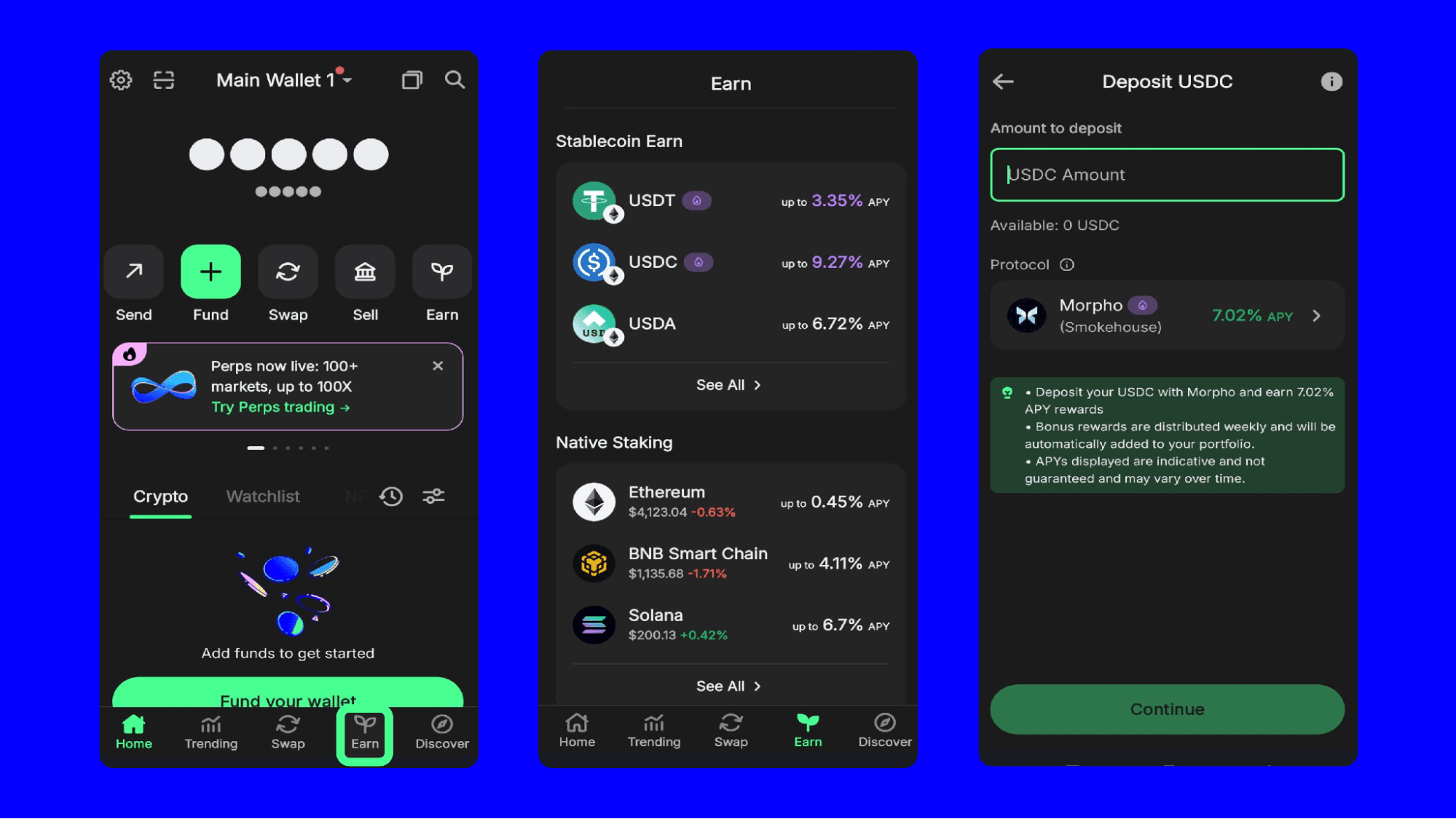

Stablecoin Earn doesn't require lockup periods. You can deposit stablecoins like USDT, USDC, DAI, or USDA and start receiving daily rewards through transparent, automated protocols. The Earn feature is available for stablecoins across multiple networks, including Ethereum, BNB Smart Chain, Arbitrum, and Base.

Stablecoin Earn offers more flexibility than traditional staking options. You can withdraw your funds anytime without penalties or waiting periods. The protocols integrated into Trust Wallet include established DeFi platforms like Morpho, Aave, Compound, Venus, and Spark. These protocols use your stablecoins for lending activities, and you receive a portion of the interest paid by borrowers.

The earning process is straightforward. You select the stablecoin you want to use, enter the amount you want to deposit, and choose a protocol. Throughout the earning process, you maintain full control of your private keys with Trust Wallet. You can track your earnings directly on the token details page.

Accessing Advanced DeFi Strategies

Trust Wallet's dApp browser opens access to a wider range of DeFi protocols and earning strategies. The browser lets you connect with decentralized applications directly from your wallet, enabling lending, borrowing, and participation in yield optimization protocols.

Lending protocols enable you to supply your crypto assets to borrowers in exchange for interest payments. The platforms use smart contracts to automate the lending process and distribute returns to lenders. The interest rates fluctuate based on supply and demand within each protocol, and you can typically withdraw your assets along with earned interest at any time.

Yield optimizers are a more advanced strategy. The protocols automatically move your funds between different DeFi platforms to capture the highest available rates. Yield optimizers continuously monitor rates across multiple protocols and reallocate assets to maximize yield.

Connecting to DeFi Protocols

Using the dApp browser to access external DeFi protocols requires connecting your wallet to the platform. Trust Wallet supports secure connection methods, including Wallet Connect, which creates an encrypted link between your wallet and web-based applications.

Always verify you're connecting to legitimate platforms by checking the URL carefully. Trust Wallet provides transparent prompts that show exactly what permissions a dApp is requesting. You can approve or reject these requests, and you maintain full control over which applications can interact with your wallet.

Making Informed Decisions

Each option has its risks and rewards. Staking offers predictable returns, but you must lock your assets for specific periods. Stablecoin Earn provides flexibility and consistent yields, and minimizes exposure to price volatility. Advanced DeFi strategies through the dApp browser can potentially generate higher returns but call for more active management and carry additional risks.

Your choice depends on your financial goals, risk tolerance, and liquidity needs. Conservative approaches like stablecoin earning work well if you want steady returns with immediate access to your funds. Staking suits people who can commit assets for longer periods while supporting network security. DeFi protocols accessed through the dApp browser offer opportunities for experienced crypto investors comfortable with more complex strategies.

Your Crypto, Working for You

Trust Wallet enables you to optimize your crypto strategy through multiple accessible pathways. Whether you choose the simplicity of in-app staking and stablecoin earning or explore sophisticated DeFi strategies through the dApp browser, you maintain self-custody of your assets throughout the process. The platform's integration of earning features directly into the wallet interface removes barriers that often prevent people from putting their crypto to work.

Disclaimer: Content is for informational purposes and not investment advice. Web3 and crypto come with risk. Please do your own research with respect to interacting with any Web3 applications or crypto assets. View our terms of service.

Join the Trust Wallet community on Telegram. Follow us on X (formerly Twitter), Instagram, Facebook, Reddit, Warpcast, and Tiktok

Note: Any cited numbers, figures, or illustrations are reported at the time of writing, and are subject to change.