Web3

AI-Powered Price Predictions: Should You Trust ChatGPT’s Crypto Forecasts?

投稿をシェア

概要

Discover why AI price predictions fail in crypto markets. Learn about XRP and Pepe examples and explore secure alternatives for crypto research.

Key Takeaways:

AI price predictions lack real-time data and rely on outdated information, making them unreliable for crypto investment decisions.

Some AI models cannot access live market data or predict sudden market shifts and regulatory changes.

Always conduct your own research and use multiple sources when making crypto investment decisions.

Artificial intelligence has transformed how we access information, but when it comes to crypto price predictions, can you really trust what ChatGPT tells you? AI Crypto tools have become popular sources for investment advice, yet their limitations in cryptocurrency markets raise serious questions about their reliability. Understanding these limitations helps you make better investment choices while staying protected from potential losses.

This article explores why AI predictions fall short in crypto markets, examines real examples from popular tokens, and shows how Trust Wallet supports safe crypto learning.

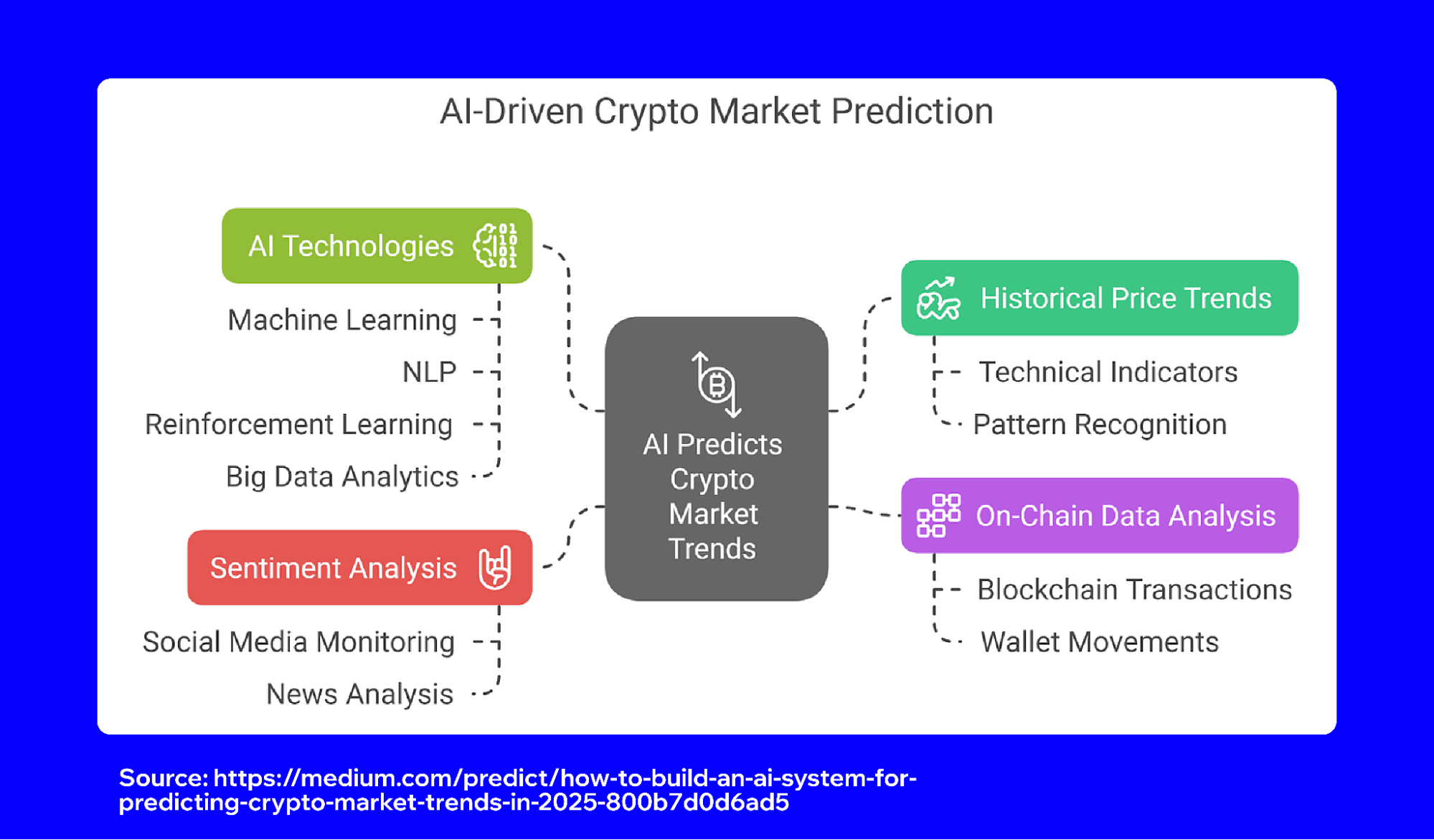

Understanding AI Predictions in Crypto Markets

Some AI models face fundamental challenges when analyzing cryptocurrency markets. These systems cannot access real-time market data or breaking news that drives sudden price movements. Most AI predictions rely on historical patterns and outdated information, making them unsuitable for volatile crypto markets where prices can change dramatically within minutes.

ChatGPT operates with a knowledge cutoff date, meaning it lacks awareness of recent developments, regulatory announcements, or market trends. Cryptocurrency prices respond instantly to news events, social media sentiment, and regulatory changes that AI models simply cannot process in real-time. The disconnect between AI training data and current market conditions creates unreliable predictions.

The cryptocurrency market operates differently from traditional financial markets. Factors like community sentiment, meme culture, and viral social media posts can drive massive price movements that no AI model can predict. These unique characteristics make crypto predictions particularly challenging for AI systems designed to analyze more predictable data patterns.

Real-World Examples: When AI Predictions Miss the Mark

XRP Price Movements and Legal Developments

XRP demonstrates how legal and regulatory news can make AI predictions obsolete overnight. When Ripple faced SEC litigation, XRP prices fluctuated wildly based on court filings, settlement rumors, and regulatory statements. AI models trained on historical data couldn't predict how these legal developments would affect XRP prices, making their forecasts meaningless during critical trading periods.

Recent XRP price movements have defied many AI predictions as the token responded to partnership announcements, regulatory clarity initiatives, and broader crypto market sentiment. These rapid changes highlight why real-time information access matters more than historical pattern analysis in crypto markets.

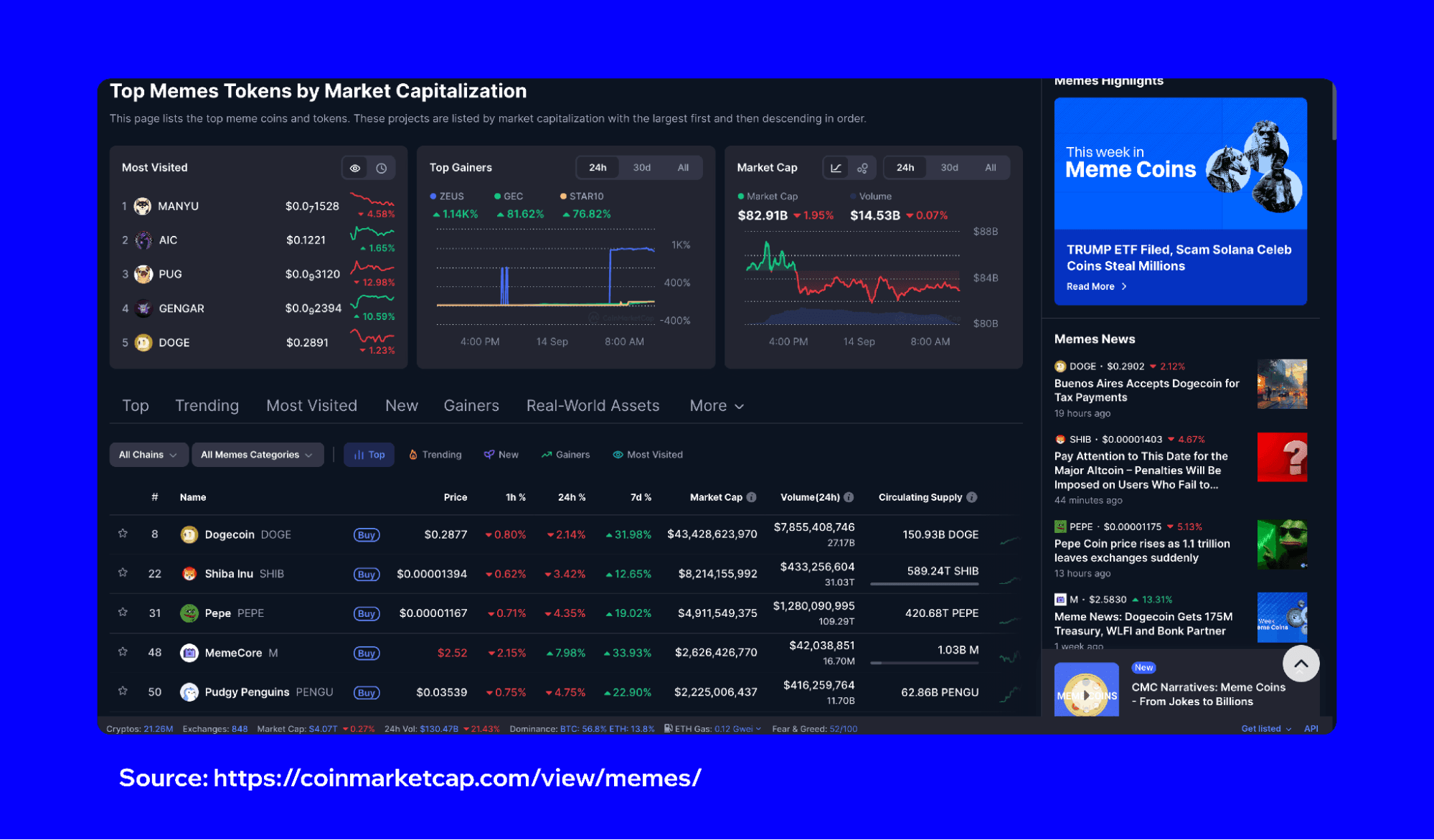

Pepe Token and Meme Coin Volatility

Meme coins like Pepe present unique challenges for AI price predictions. These tokens often experience explosive growth or sudden crashes based on social media trends, celebrity endorsements, or community-driven campaigns. AI models cannot process the cultural and social factors that drive meme coin prices, making their predictions particularly unreliable.

Pepe's price history shows dramatic spikes followed by steep declines that correlate with viral social media content rather than traditional market indicators. AI predictions based on technical analysis patterns fail to account for the social dynamics that actually determine meme coin values.

The Limitations of AI-Powered Price Predictions

Data Lag Issues

Some AI models work with information that's weeks or months old, missing crucial real-time developments that drive crypto prices. Market-moving news happens constantly in crypto, making historical data less relevant for future predictions.

Regulatory Blindness

AI cannot predict government announcements, regulatory changes, or legal developments that heavily influence crypto prices. These events often cause the most significant price movements in cryptocurrency markets.

Social Sentiment Gaps

Cryptocurrency prices are heavily influenced by social media trends, community sentiment, and cultural movements that AI models struggle to interpret accurately. The human emotional factors that drive crypto adoption remain largely invisible to AI analysis.

Technical Analysis Limitations

While AI can identify chart patterns, crypto markets often break traditional technical analysis rules. Sudden whale movements, exchange-related events, and protocol-specific developments create price action that doesn't follow historical patterns.

Better Approaches to Crypto Research

Instead of relying on AI predictions, develop research skills using multiple reliable sources. Crypto news websites, project whitepapers, and community discussions provide more current information than AI models can offer. Combine technical analysis with fundamental research to form balanced investment opinions.

Use Trust Wallet's integrated browser to explore project websites, read documentation, and verify official social media channels. This direct research approach gives you firsthand information rather than AI interpretations of outdated data.

Follow official project announcements, regulatory news, and industry reports from established sources. These information channels provide the real-time updates that AI models miss, helping you stay informed about factors that actually influence crypto prices.

Consider market sentiment tools and on-chain analytics platforms that provide real-time data about trading activity, whale movements, and network usage. These resources offer current information that supports better decision-making than AI predictions based on historical data.

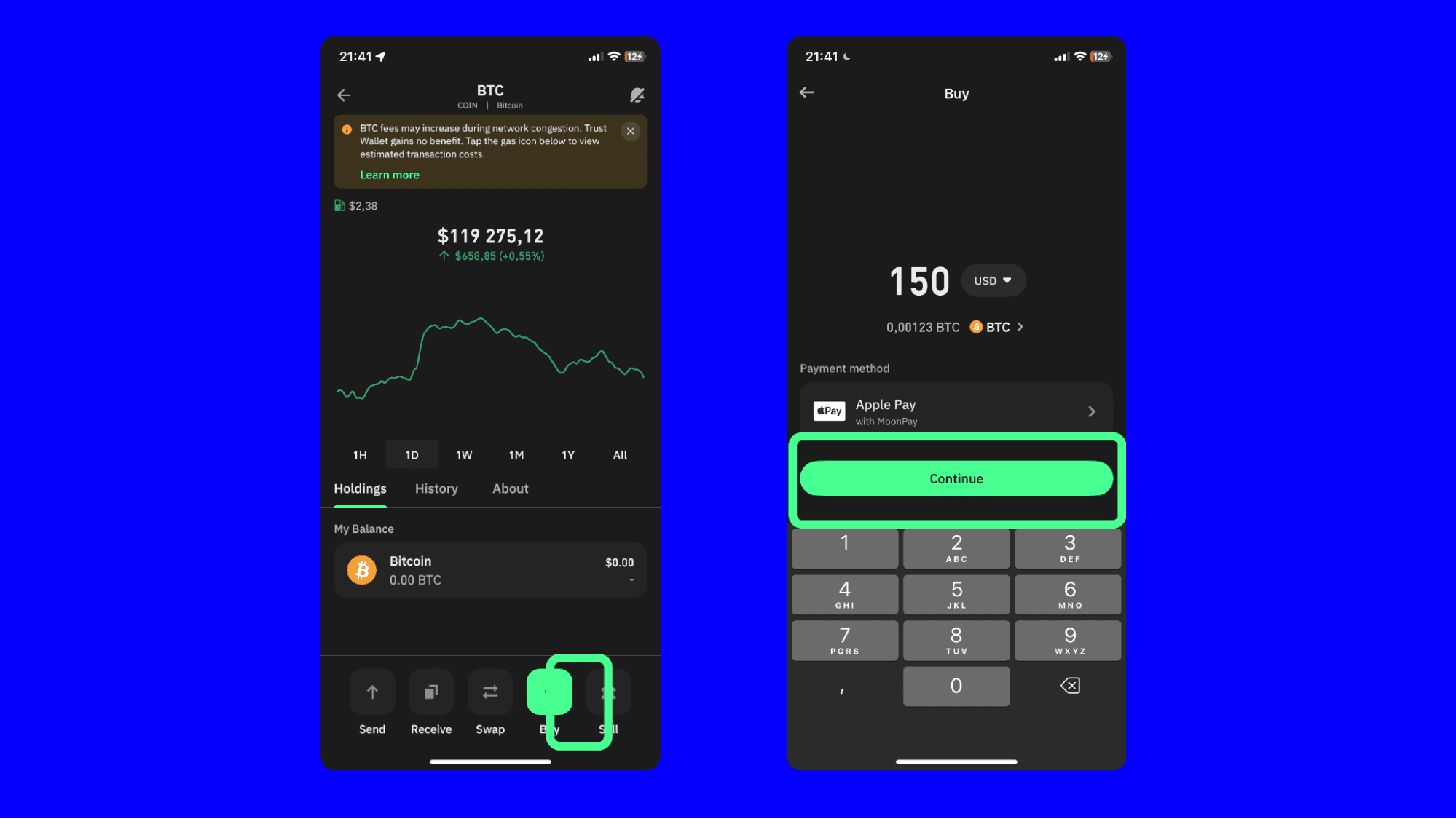

How to Buy Crypto Using Trust Wallet

You can buy crypto, including Bitcoin, using Trust Wallet, via our trusted partners. Here’s how:

If using the mobile app:

Search for your desired crypto, for example: “Bitcoin” or “BTC” and select it.

Click the “buy” button.

Enter the amount of BTC you want to purchase.

Select the third party provider & payment method you’d like to use.

Select “Continue” and complete the remaining steps.

If using the browser extension:

Choose your preferred currency and amount, then choose Bitcoin (BTC).

Select your preferred third party provider.

Complete the remaining steps.

Closing Thoughts

AI price predictions for cryptocurrencies carry significant limitations that make them unreliable for investment decisions. The inability to access real-time data, process social sentiment, or predict regulatory developments means AI forecasts often miss the mark in volatile crypto markets. Examples from XRP and Pepe demonstrate how quickly market conditions change in ways that AI models cannot anticipate.

Rather than depending on AI predictions, focus on building knowledge about blockchain technology, project fundamentals, and market dynamics that drive real price movements. Remember that cryptocurrency investment carries inherent risks, and no prediction method guarantees success. Always conduct thorough research, never invest more than you can afford to lose.

Download Trust Wallet

Disclaimer: Content is for informational purposes and not investment advice. Web3 and crypto come with risk. Please do your own research with respect to interacting with any Web3 applications or crypto assets. View our terms of service. Join the Trust Wallet community on Telegram. Follow us on X (formerly Twitter), Instagram, Facebook, Reddit, Warpcast, and Tiktok

Note: Any cited numbers, figures, or illustrations are reported at the time of writing, and are subject to change.