가이드

What are Prediction Markets in Crypto?

게시물 공유

요약

Learn how crypto prediction markets let you trade on future events, from elections to sports, using blockchain technology and smart contracts.

Key Takeaways:

Prediction markets generated over $27.9 billion in trading volume between January and October 2025, showing rapid mainstream adoption.

These platforms use blockchain and smart contracts to let you trade on outcomes of real-world events like elections, sports, and crypto prices.

Polymarket correctly predicted the 2024 US presidential election with 95% accuracy before midnight on election day, outperforming traditional polls.

Prediction markets in crypto let you put your money where your opinion is. Instead of guessing who will win the next election or whether Bitcoin will hit a certain price, you can trade on these outcomes. The market prices reflect what thousands of people collectively believe will happen, and blockchain technology makes the whole process transparent and automatic.

These platforms have exploded in popularity recently. Between January and October 2025, prediction market platforms generated over $27.9 billion in trading volume. The sector is projected to potentially reach $95.5 billion by 2035 as more people discover how these markets work. In this article, we explore how prediction markets operate, what makes them different from traditional betting, and why they've become a growing part of the crypto ecosystem.

The Mechanics Behind Prediction Markets

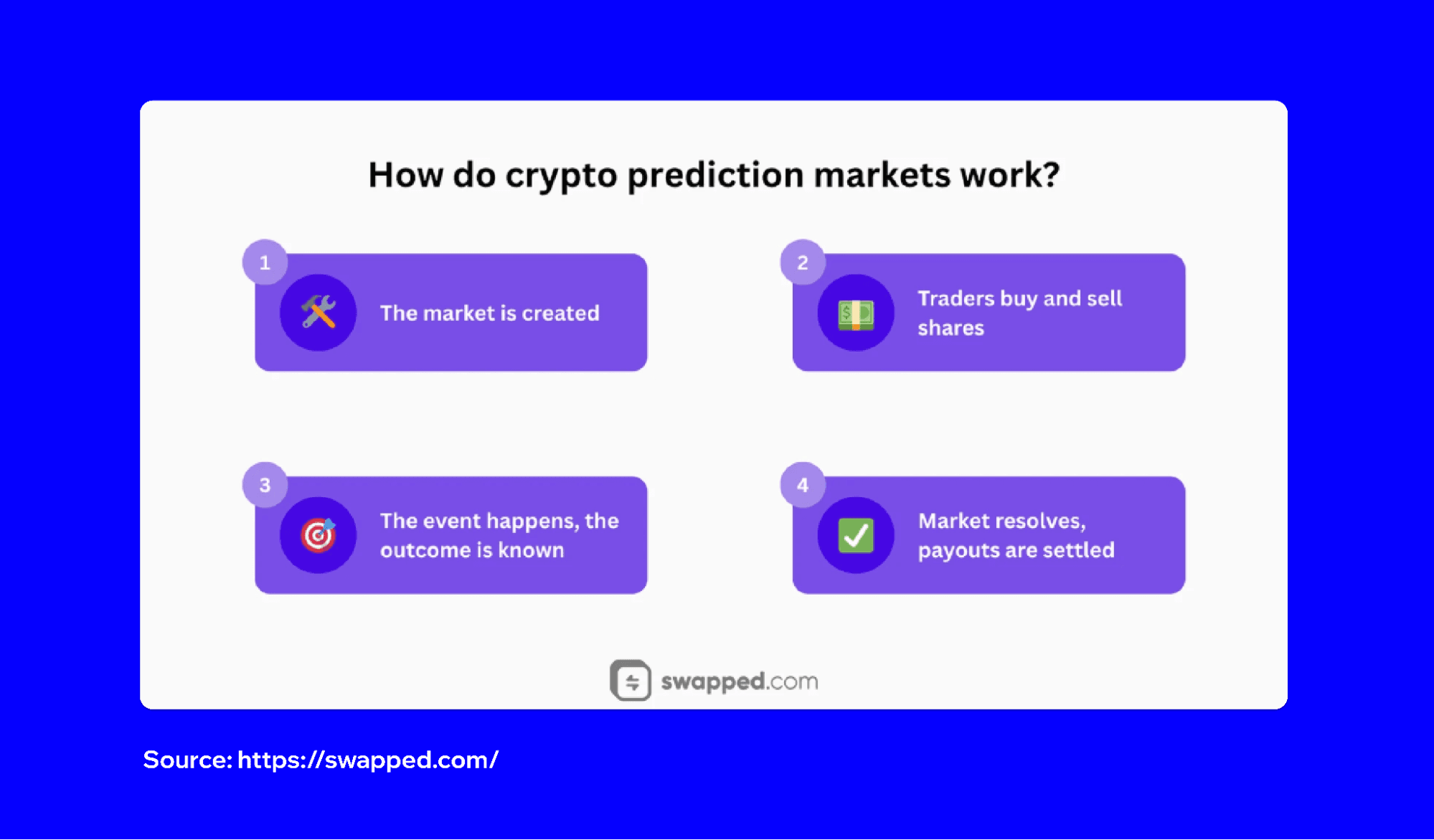

Prediction markets are platforms where you can buy and sell shares that represent the outcome of an event. Each share's price reflects the market's collective belief about how likely something is to happen.

When a prediction market asks whether Bitcoin will reach $150,000 by year-end, there are two tokens you can trade: "Yes" and "No".

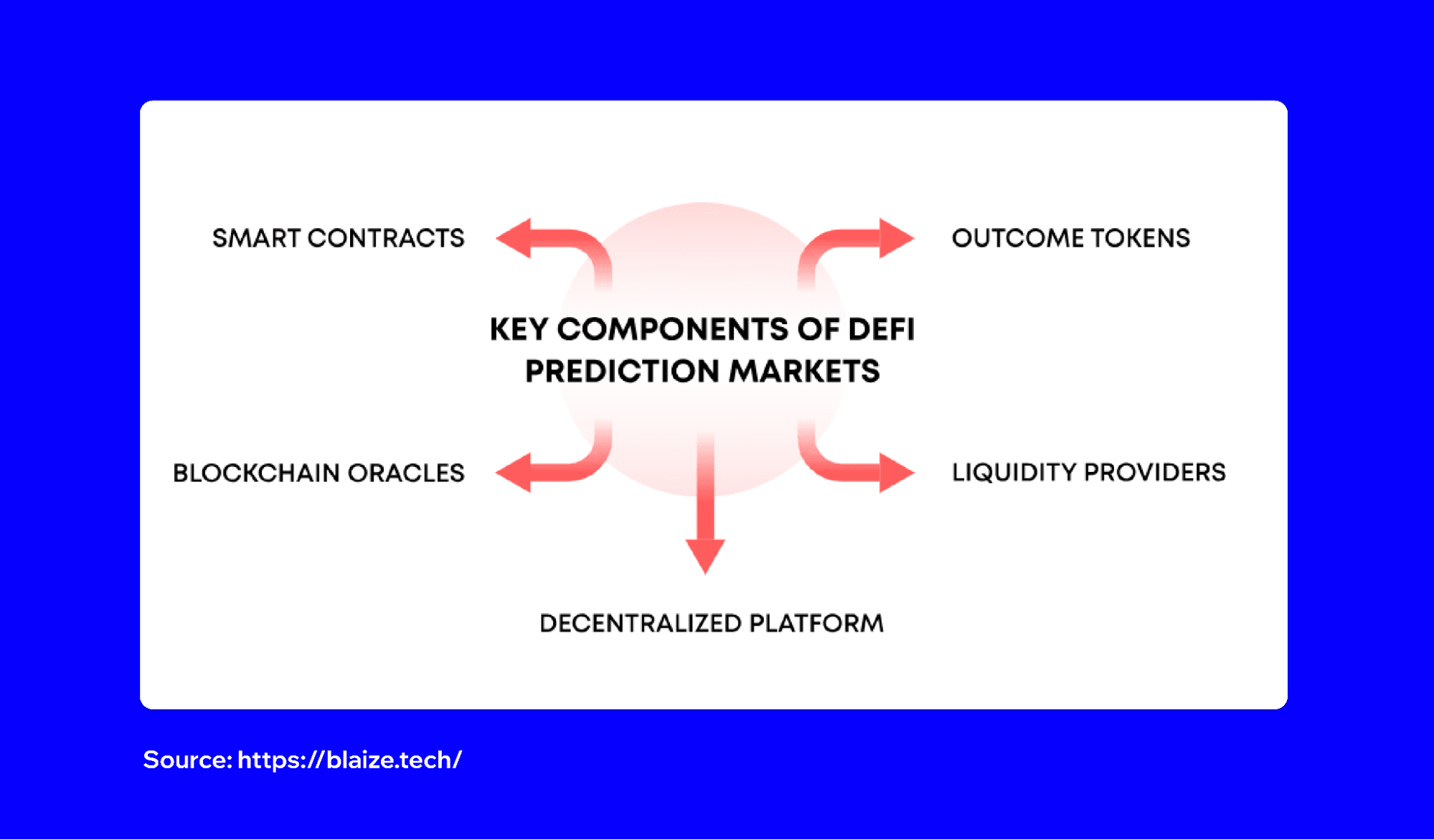

With crypto prediction markets, smart contracts on a blockchain replace traditional operators. You don't need to trust a company to hold your funds or settle outcomes fairly. The smart contract handles everything automatically based on the rules that everyone can see and verify.

Smart Contracts and Automatic Settlements

When an event ends, a decentralized oracle checks the final result and records it on the blockchain. Smart contracts then pay out automatically to holders of the winning outcome, without any manual intervention or withdrawal delays. Platforms like Polymarket use trusted data providers to confirm results, ensuring speed and clarity in how outcomes are finalized.

Many decentralized prediction markets use automated market makers, or AMMs, to price outcomes. Trading is continuous. You can enter or exit positions at any time before the event closes. You need to lock collateral, usually stablecoins like USDC, when you buy YES or NO tokens. At settlement, the winning tokens are redeemed.

The Rise of Crypto Forecasting

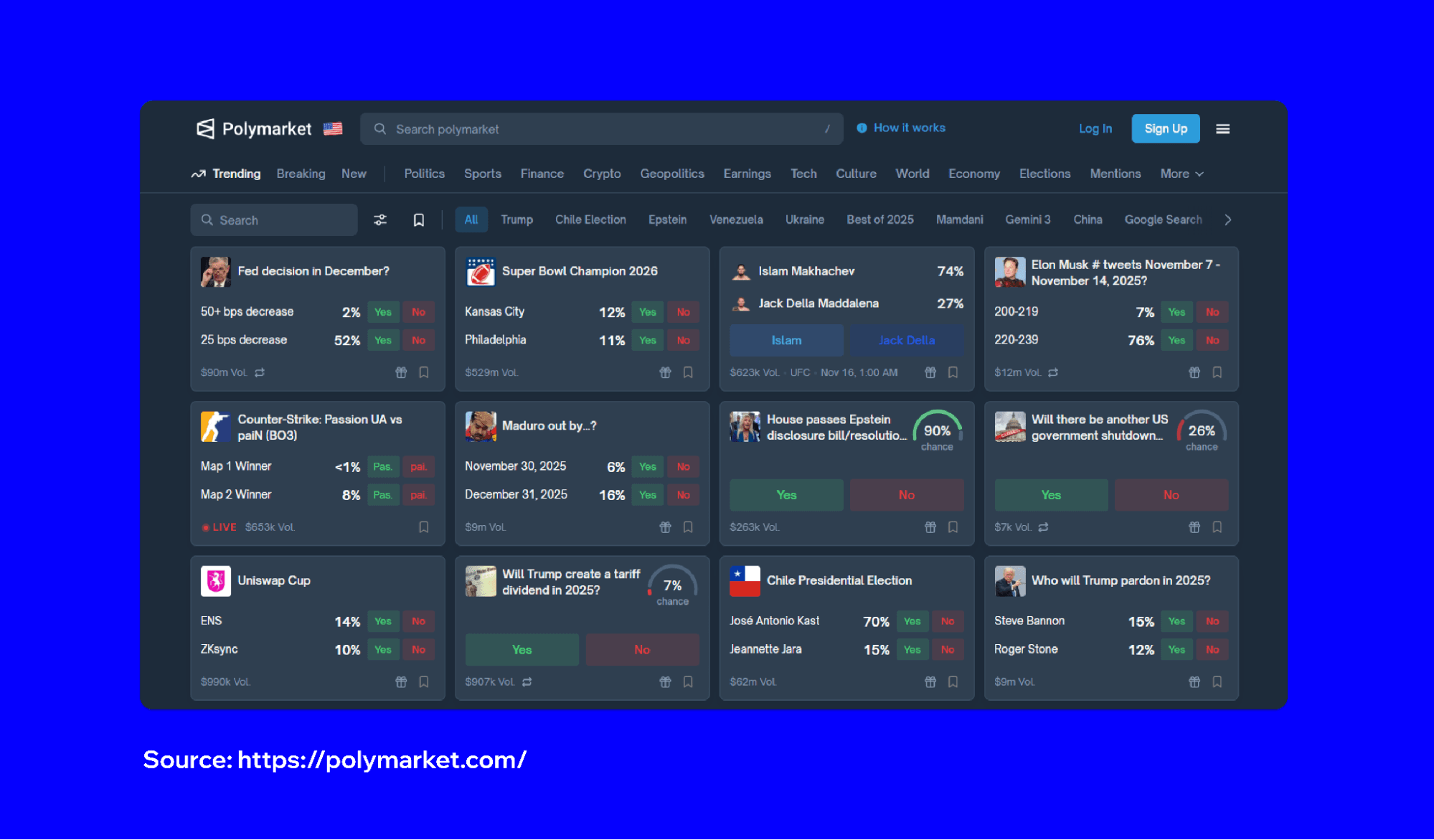

The numbers tell a compelling story. Polymarket, the largest decentralized prediction market, has recorded over $18.4 billion in trading volume. Polymarket saw its open interest rise to around $170 million, with approximately 40% of volume coming from sports betting and 40% from crypto price predictions. On November 6th alone, trading volume hit $350 million.

What started as political betting in 1503, when people could bet on who would become the next pope, has become a sophisticated financial tool. Prediction markets have existed for years, however, they exploded in popularity in 2024 thanks to smart contracts that enabled people to bet on elections. In just a few weeks, millions of people used these contracts to bet on whether Donald Trump or Kamala Harris would win the U.S. presidential election.

What People Are Betting On

Elections have become one of the most discussed topics on prediction markets. The 2024 U.S. presidential election demonstrated the potential accuracy of these platforms. Polymarket had the odds of President Trump winning at 95% before midnight on election day, several hours before the Associated Press called the election. Polymarket predicted the outcome more accurately than traditional polls, particularly in swing states like Arizona, Georgia, North Carolina, and Nevada.

Sports betting is another major category, with crypto-based prediction markets offering faster settlements, global access, and transparency thanks to blockchain technology. Traditional sports betting faces limitations from regulations, geographic restrictions, and slow payouts, which crypto platforms help bypass.

Crypto events themselves are popular prediction topics. You can trade on whether specific cryptocurrencies will hit certain price milestones, when network upgrades will launch, or whether regulatory changes will pass. Some platforms have markets on cultural topics, from award show outcomes to pop culture phenomena.

Leading Prediction Platforms

Polymarket dominates the space as the largest decentralized prediction market, built on Polygon for low fees and fast transactions. Polymarket trades in USDC stablecoin for price stability and charges no trading fees on transactions.

Kalshi is a regulated alternative, surging from 3.3% market share to 66% by September 2025. Kalshi operates under CFTC regulation and finalizes event outcomes through official government data releases and reputable news sources.

Augur pioneered the space when it launched in 2018 as the first decentralized prediction market. Augur’s DAO has dissolved, but the platform’s technological innovations continue to influence the broader DeFi ecosystem. Augur settled around $20 million in bets during 2018-2019, which was impressive for that era.

Why the Surge in Adoption

Technology and the ease of opening new accounts has made it easier to enter the prediction market. The platforms have stripped away much of the technical complexity, attracting people who aren't crypto native.

Regulatory clarity has also played a role in prediction market’s increased popularity. The transition from a hostile regulatory environment to a more supportive one in 2025 has helped legitimize prediction platforms. When prediction markets showed their accuracy during major events like the 2024 election, confidence grew among retail and institutional participants.

How to Access Prediction Markets in Trust Wallet

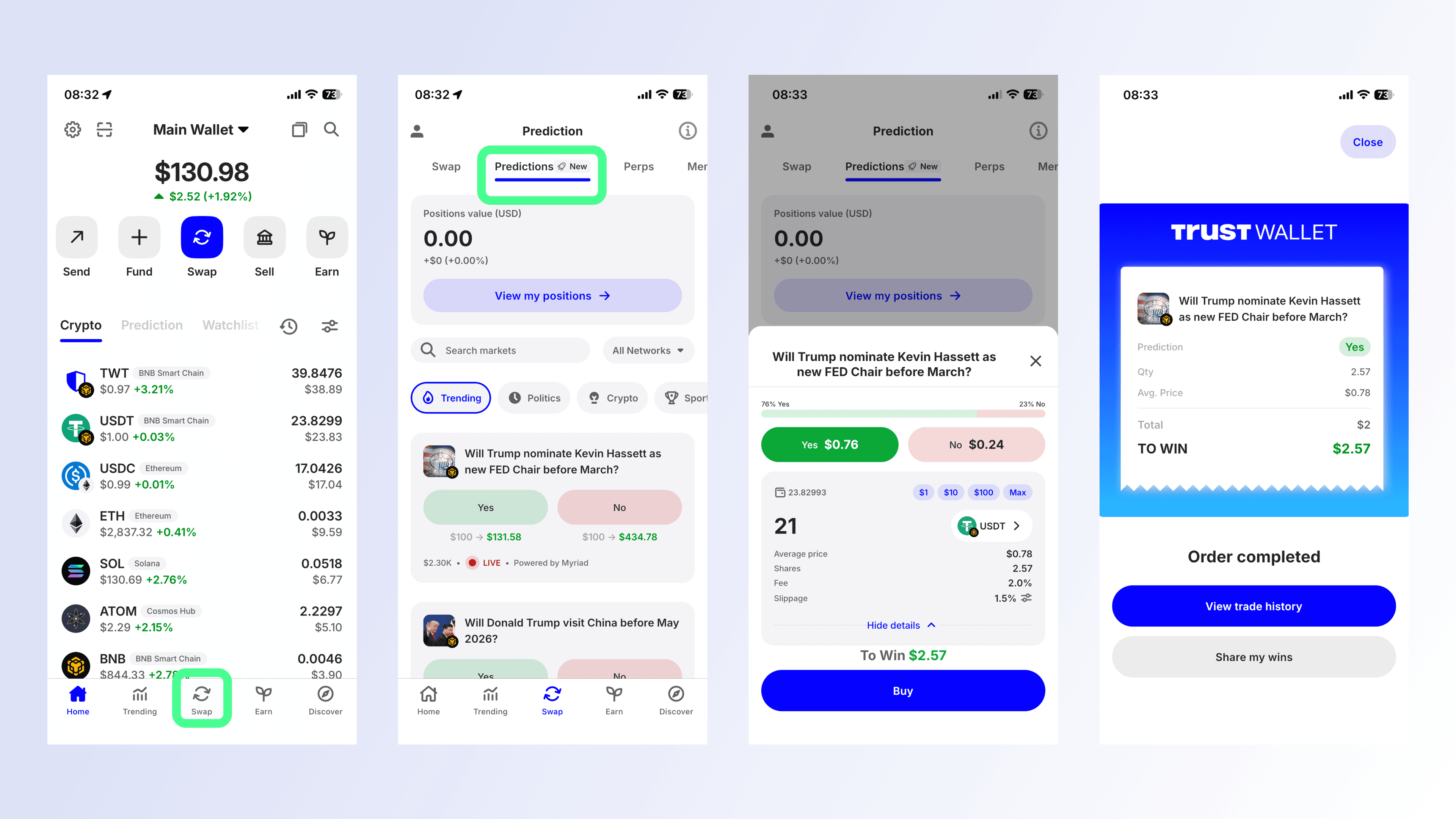

Connecting to prediction market platforms is simple using Trust Wallet. Here’s how:

Open the Trust Wallet app

Access Predictions via the Trade menu option, and search for a prediction you’d like to trade on.

Select Yes or No to predict and then choose your amount.

Select Continue to complete the steps.

Once done, view and share your position.

Looking Ahead

Prediction markets have proven they can be a valuable tool for gauging public sentiment and forecasting outcomes. The success of platforms like Polymarket and Kalshi has demonstrated that these prediction market contracts can become a new asset class for both retail and institutional investors. As the sector continues to grow, you can expect wider adoption, more diverse event categories, and deeper integration with traditional financial products.

The combination of blockchain transparency, automated settlement, and the wisdom of crowds creates a powerful forecasting tool. Whether you're interested in politics, sports, crypto prices, or cultural events, prediction markets give you a way to participate directly in forecasting the future and earn returns based on the accuracy of your views.

Disclaimer: Content is for informational purposes and not investment advice. Web3 and crypto come with risk. Please do your own research with respect to interacting with any Web3 applications or crypto assets. View our terms of service.

Join the Trust Wallet community on Telegram. Follow us on X (formerly Twitter), Instagram, Facebook, Reddit, Warpcast, and Tiktok

Note: Any cited numbers, figures, or illustrations are reported at the time of writing, and are subject to change.