BLOG_PAGE.section-article.category.rwa-

How to Use Trust Wallet to Explore Tokenized Securities When They Launch

Поделиться

Вкратце

Learn how to use Trust Wallet to add, manage, and trade tokenized securities safely with guidance on watchlists and risk management strategies.

Key Takeaways:

Trust Wallet makes tokenized securities accessible through the familiar swap interface, requiring a few taps to gain exposure to traditional assets like stocks and ETFs.

Trust Wallet's Security Scanner and self-custody model provide robust protection. Risk management tools help you navigate the challenges of tokenized securities trading.

Access to tokenized securities depends on your location. There are restrictions in the US, UK, and EU. It is important to understand local regulations before participating.

Tokenized securities have changed how people access traditional financial markets through blockchain technology. Trust Wallet has launched support for tokenized real-world assets, including stocks and ETFs, enabling over 200 million people to access these assets directly from their smartphones. This guide gives you a clear roadmap for navigating tokenized securities.

Understanding Tokenized Securities in Trust Wallet

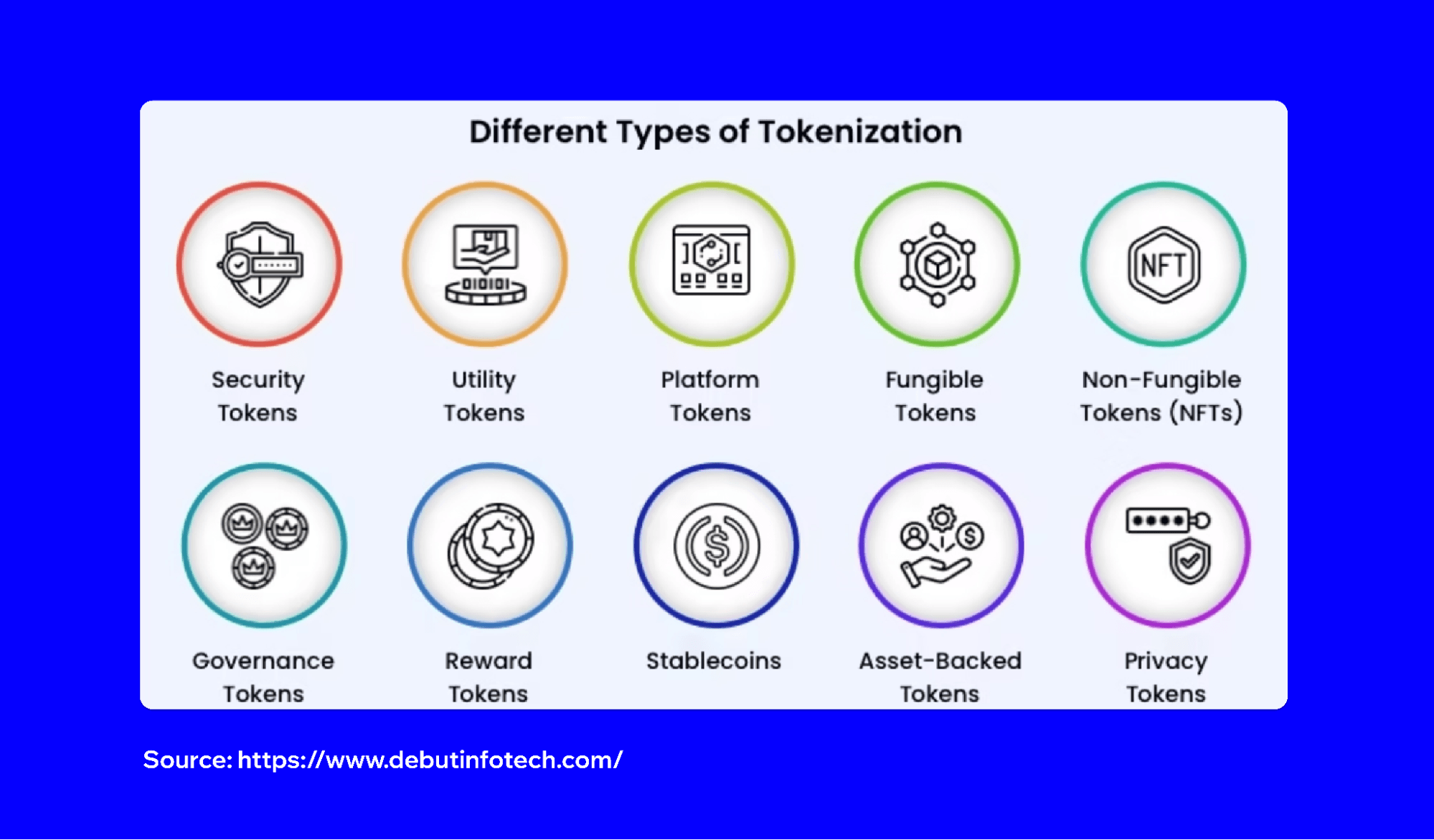

Tokenized securities are digital tokens that represent ownership or exposure to real-world financial assets like stocks, bonds, and ETFs. Tokenized securities track the price performance of underlying securities while operating through smart contracts. In Trust Wallet, these assets appear as RWA tokens that you can swap, hold, and manage just like cryptocurrencies.

The tokens currently available through Trust Wallet include major U.S. stocks like Apple (appearing as AAPLon) and Tesla, plus various ETFs. These tokens provide price exposure to the underlying assets but typically don't grant traditional shareholder rights like voting or direct dividend payments.

Adding Tokenized Securities to Your Portfolio

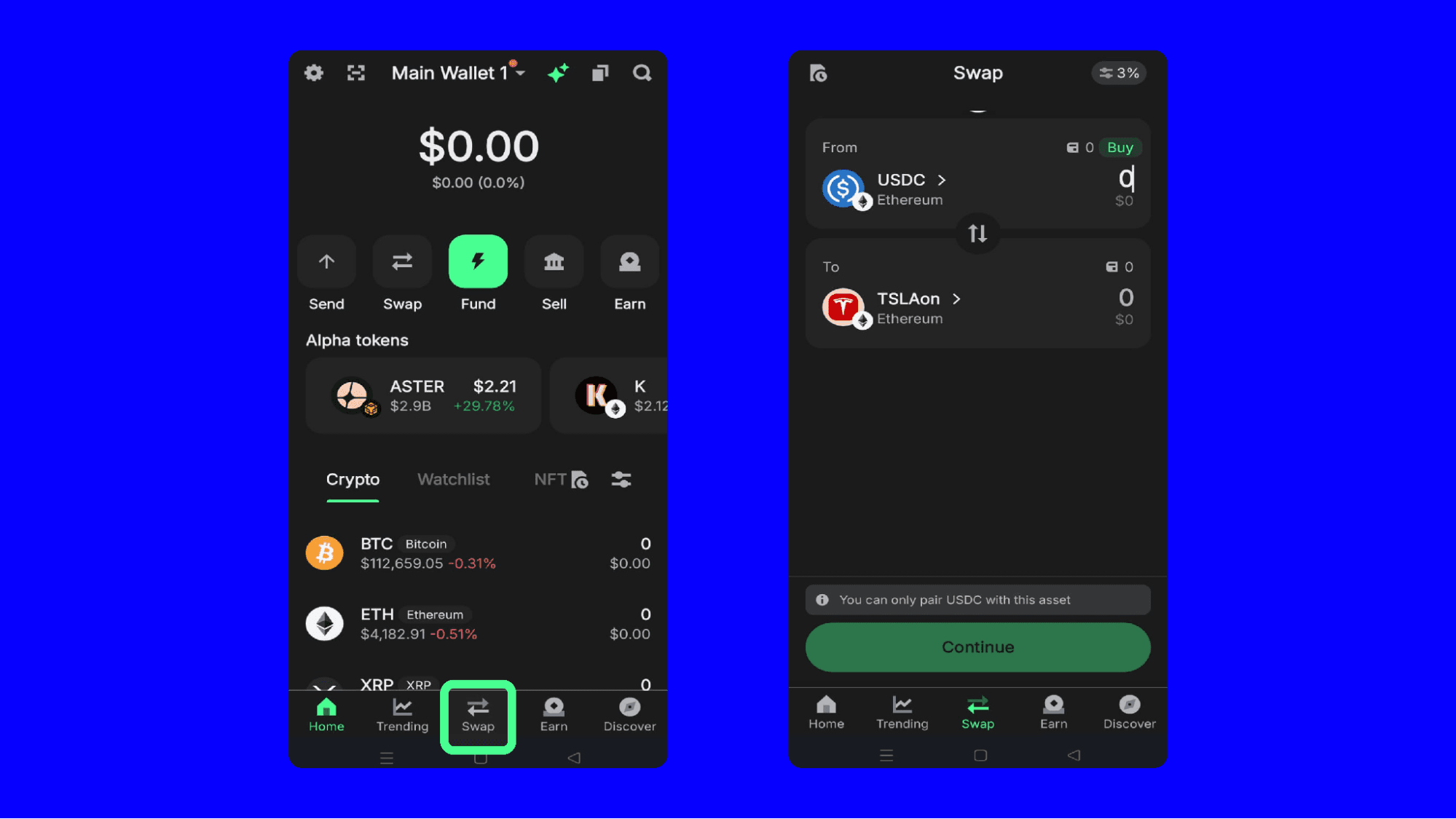

Getting started with tokenized securities in Trust Wallet follows the same process as swapping any cryptocurrency. Navigate to the "Swap" tab at the bottom of your main screen. The interface displays available tokenized assets alongside regular cryptocurrencies.

Select your source asset as your starting point. The platform currently supports swaps on the Ethereum network. Other networks like BNB Chain and Solana are planned. Choose your desired tokenized security from the available options, which may display with modified tickers like AAPLon for Apple shares.

Enter the amount you want to swap and review the transaction details carefully. Trust Wallet provides real-time quotes powered by third-party providers and processes swaps through the 1inch API for optimal routing.

Trading hours align with traditional U.S. market hours (24 hours a day, five days a week). 24/7 trading capabilities are under development.

Creating Effective Watchlists

Trust Wallet's portfolio management features let you monitor your tokenized securities alongside your cryptocurrency holdings. Once you've got your tokenized assets, they appear in your main wallet balance where you can track their performance.

Trust Wallet's "Manage crypto" feature lets you organize which assets display prominently in your wallet interface. Access your manage crypto feature by scrolling to the bottom of your asset list and selecting "Manage crypto," then use the toggle switches to control which tokenized securities appear in your main view.

Important Risk Management Strategies

Trust Wallet has several built-in security features to protect you when interacting with tokenized securities and other digital assets. The Security Scanner evaluates transactions and provides warnings before you confirm swaps or transfers. The proactive warning system assigns risk levels ranging from low to high and alerts you to potentially malicious addresses or smart contracts.

Trust Wallet's self-custody model gives you complete control over your private keys and assets. You are fully responsible for protecting your assets. Enable biometric authentication and PIN protection to prevent unauthorized access to your wallet.

Technical Requirements and Setup

Ensure you have the latest version of the Trust Wallet app installed to access tokenized securities, as they are recent additions to the platform. Trust Wallet handles swaps through DeFi protocols. The transactions are decentralized, and you get competitive rates. Your transactions are completed directly on the blockchain, usually within a few minutes, depending on how busy the network is.

Keep enough ETH in your wallet to cover gas fees for Ethereum-based transactions. Gas fees vary based on network activity and can affect the overall cost of swapping or trading tokenized securities. Trust Wallet displays estimated fees before you confirm transactions, letting you make informed decisions about timing and amounts.

Regulatory Considerations and Access

The availability of tokenized securities through Trust Wallet depends heavily on your geographic location and local regulations. The platform implements geo-blocking to prevent access from restricted jurisdictions, ensuring compliance with various financial regulations worldwide.

People in eligible regions can access these features without traditional Know Your Customer (KYC) requirements that typically accompany brokerage accounts. Permissionless access is a major advantage for people in emerging markets or regions with limited traditional financial infrastructure.

The regulatory landscape for tokenized securities is constantly evolving. Major exchanges like Nasdaq have submitted proposals to the SEC for trading tokenized securities alongside traditional stocks. These developments could expand access and legitimacy for tokenized securities across the broader financial sector.

Looking Ahead

The integration of tokenized securities into Trust Wallet is just the beginning of a broader shift in how people access financial markets. The tokenized securities market is projected to reach $77 billion by 2031.

Trust Wallet plans to expand from the current 100+ available assets to over 1,000 tokenized securities by the end of 2025. For people in currently restricted regions, growing institutional acceptance and regulatory developments may eventually expand access as major exchanges like Nasdaq propose trading tokenized securities.

Removing traditional barriers like brokerage accounts and minimum investment thresholds will make investment opportunities accessible to anyone with a smartphone. As tokenized securities become mainstream, Trust Wallet ensures you’re well positioned to participate in the democratization of global financial markets.

Download Trust Wallet Disclaimer: Content is for informational purposes and not investment advice. Web3 and crypto come with risk. Please do your own research with respect to interacting with any Web3 applications or crypto assets. View our terms of service.

Join the Trust Wallet community on Telegram, X (formerly Twitter), Instagram, Facebook, Reddit, Warpcast, and Tiktok

Note: Any cited numbers, figures, or illustrations are reported at the time of writing, and are subject to change.